Templar Mainnet

The Dawn of Cypher Lending

Templar, the first Cypher Lending Protocol, is now live on mainnet. With Templar, Bitcoin finally has its own lending facility that doesn’t depend on banks, exchanges, or any centralized intermediary. You can now borrow U.S. dollars (via stablecoins) against your Bitcoin without trusting third parties (TTPs). Instead, an MPC network and immutable smart contracts ensure your Bitcoin can never be frozen, seized, or rehypothecated without your consent. In short: No wrapping, no bridging, no KYC.

What makes Templar different is that it uses native assets from any chain. It was built for those of us who refused to accept that trusted third parties are necessary for good UX. The key ideological pillars of Cypher Lending are:

Permissionless: No approvals, no credit checks, no invasive KYC hoops. Anyone, anywhere in the world, can use Templar directly from their wallet. Borrowing and lending for any asset on any chain is open to all. Even the deployment of new markets or vaults is permissionless.

Open Source & Unstoppable: The protocol’s rules are enforced entirely by open-source code. There are no backdoors or “trust us” admin keys – in fact, Templar’s smart contracts are intentionally non-upgradable to prevent any hidden tampering. Running on decentralized rails means Templar can’t be easily shut down or censored.

Private: Financial privacy is a first-class priority. The platform collects zero personal information. And this is just the beginning: upcoming upgrades will integrate technologies like differential privacy and zero-knowledge proofs to protect users from predatory liquidations and preserve on-chain anonymity. Uniquely, Templar will even require users to connect a typical smart contract wallet interface to interact – you can simply send Bitcoin to the protocol and provide a return address for the stablecoins, no on-chain identity or tracking needed.

Chain Agnostic: We love both Bitcoin and Crypto. We don’t believe in forcing users to be limited to a single chain or stablecoin. We believe in allowing users the choice to borrow with their preferred asset on any chain without wrapping, bridging, or trusting centralized intermediaries. To start, we support Bitcoin, Ethereum assets, and NEAR assets with many more assets and chains on our Roadmap. Concretely, this means you can deposit native BTC as collateral and borrow stablecoins like USDT on Ethereum or NEAR.

Templar gives Bitcoin holders access to a medium of exchange (dollars) backed by their store-of-value asset. Inspired by the writings of Nick Szabo, Templar fuses cutting-edge MPC technology with cypherpunk ideals, proving that you can leverage crypto assets on your terms. You can borrow against your Bitcoin without ever handing it over to a bank or exchange. With Templar, your assets work for you with no one standing in the way.

The Rise of Bitcoin DeFi

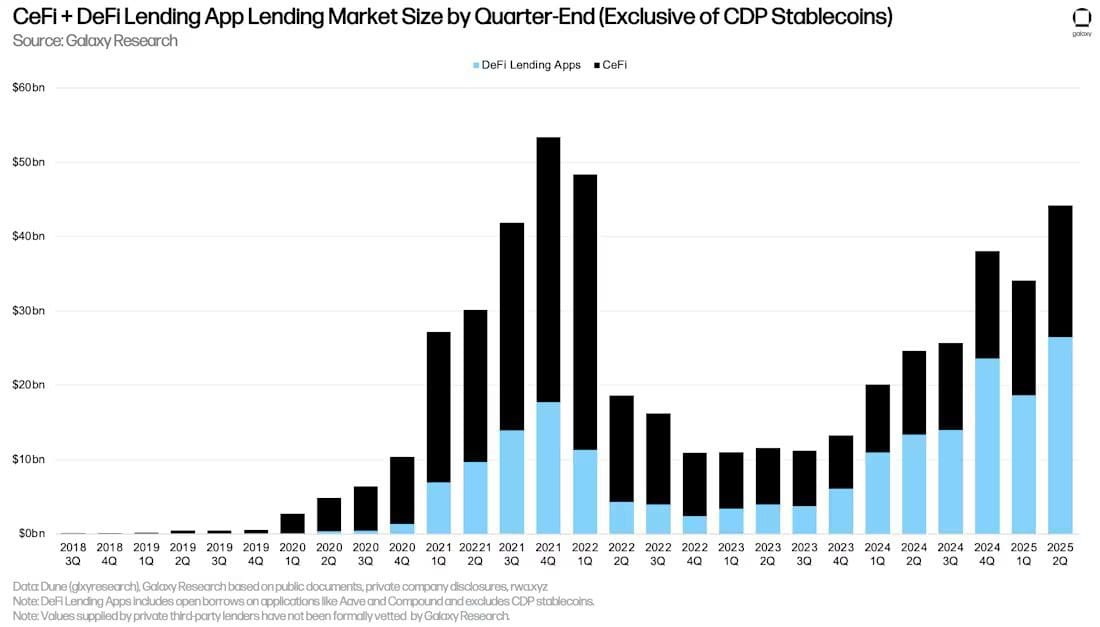

In Q4 2021, The Crypto Lending market reached its peak of almost $50B dominated by centralized lenders like BlockFi, Celsius, and Genesis beating out DeFi lending almost 2:1 with CeFi loans accounting for 66% of Crypto loans with DeFi loan accounting for the remaining 34% according to Galaxy Digital’s The State of Crypto Lending Report.

By the end of Q2 2025, DeFi loans had flipped CeFi loans with a 60% majority of outstanding loans occurring on DeFi lending protocols like Aave.

The growth of DeFi lending has outpaced CeFi Lending over the last few years. We believe that this trend will continue into 2026 and beyond, and we believe Templar will have a large part to play.

While Ethereum erc-20 assets are well served by the current DeFi incumbents, Bitcoin the largest Crypto asset, has no way to borrow against it without trusting centralized intermediaries. Templar changes that. While centralized financial institutions ranging from Traditional Banks like JP Morgan Chase to Nouveau Banks like Coinbase all vie for Custody of your Bitcoin, Templar offers a Cypherpunk alternative.

“Bitcoin was created to replace banks, not to be a novel toy asset for Wall Street to financialize and control. Templar restores Bitcoin to its proper place as a permissionless, censorship resistant asset in the context of borrowing and lending,” says the pseudonymous founder of Templar Protocol, Royal F00l. “We have conviction that Bitcoin and Stablecoins are here to stay, but it’s not clear which chains or which stablecoins will be the winners given multitude of stablecoins being launched and the recent announcements of Corpo chains from Google, Stripe, JP Morgan Chase, not to mention the numerous Crypto native L1s and L2s. Templar is positioned to enable Bitcoin DeFi for any stablecoin on any chain.”

Be Your Own Bank

Our vision is a world in which you can truly be your own bank for any asset onchain. In the past, having a “Swiss bank account” was an escape hatch only for the elite. In the future, Templar will put that level of privacy and self-sovereignty in everyone’s pocket. Now, with cryptography and decentralized networks, that metaphor becomes reality for all.

This is the cypherpunk endgame. A decentralized network of sovereign individuals with a full stack of p2p financial services can finally outmaneuver the State and banking leviathans, removing their ability to freeze or seize your wealth. That is Bitcoin’s promise, fulfilled. At a time when most of the focus is on institutionalization and centralization of Crypto, Templar’s mainnet launch reignites the cypherpunk spirit which birthed Bitcoin and serves as a beacon of hope for a trust minimized future. It’s a rallying cry to return to Bitcoin’s roots, to “Make Bitcoin Cypherpunk Again”.

Satoshi Nakamoto launching the Bitcoin network marked the dawn of Cypherpunk money. Now Templar is launching its protocol on Bitcoin, Ethereum, and NEAR marking the dawn of Cypher Lending. It is an inflection point where control shifts back to the individual as Wall Street looks to tighten its grip. A new sun rises for truly trustless, private, and permissionless lending as it promises to reshape the future of Bitcoin and beyond.